Investment Real Estate in Vancouver

Investing in Vancouver Real Estate can prove extremely lucrative with the right Team behind you.The Place Real Estate Team specializes in sourcing cash-flow positive investment property in the Greater Vancouver and Fraser Valley. We have been providing investment consultation for many years.

Every investor is different. Maybe you are thinking about taking your first step into Investment Property, or maybe you are a seasoned investor looking to fine-tune your portfolio. Adam Chahl and his team customize an investment plan particular to your needs.

We acknowledge the benefits of investing in real estate using the following acronym:

I.D.E.A.L:

I = Income from rents

D = Depreciation (tax benefits)

E = Equity build-up as tenants make their payments

A = Appreciation as the value of real estate grows

L = Leverage through the use of “other people’s money” and/or financial institutions

There have indeed been times during the past quarter-century when equal weight could have been placed on all five of these important factors as dimensions of profit potential. The reason was that all five of the “ideal” factors were at work at the same time.

In recent years, the government reformed the tax laws in a major way and clipped the wings of this kind of investing, except for a few lingering and selective advantages. At the same time, appreciation took a U-turn in many areas of the country. Thousands of new investors who had jumped into the fray with minimal business sense found themselves enrolled in the School of Hard Knocks – without a scholarship.

They can still enjoy equity build-up (even while they are asleep at night), and leverage is still a vitally important dimension (in many respects the most important dimension) of this type of wealth building.

The consequence of this historical shift has been to place real estate investing forcefully into the only context where it makes any kind of sense at all…. CASHFLOW.

Cash Flow Properties Vancouver

Investing in cashflow property in Vancouver is one of the smartest investments you will make in your life. We teach and follow ourselves, many strategies put forward by Robert T. Kiyosaki who encourages his readers to achieve financial freedom through the purchase of income-generating assets. The most notable being Real Estate – due mainly to the leverage that is available.

Whether you are looking to purchase your first Vancouver Cash Flow Property, supplement your income, or look towards retiring, we can find cash-positive property ideal for your needs. Contact us and we can get started right away!

Flipping Vancouver Real Estate

We’ve all seen many shows on TV these days where people make a ton of money doing not much work in a very short period of time. Most of the time, everything goes well and the investors come away on top… It’s true, there is money to be made in flipping Vancouver Real Estate, and with the guidance of the Place Real Estate Team, many of our clients make a great return.

Contact us by filling in the form to your right to have a chat with us, and see if flipping could be a suitable strategy for you.

Investment Portfolio Analysis

Do you have a current investment portfolio of one, two, or many more properties? Thinking about liquidating some assets in order to free up some borrowing power? Contact us by filling in the form below, and sit down with one of our team to analyze your current portfolio, and see how we can help maximize your cash flow.

New to Investing?

It is important to be prepared. If you are thinking about investing in Vancouver Real Estate, then get in touch with us today, to find out how the process works, and we can show you the exciting possibilities with regards to Investment Real Estate.

Fill out the form below, let's get started.

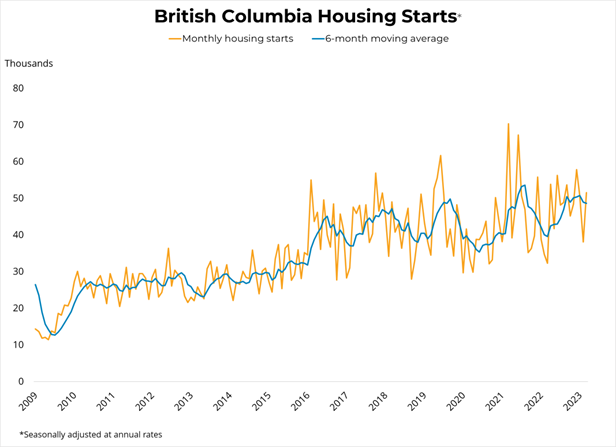

Canadian Housing Starts (March 2023)

Canadian Housing Starts (March 2023)

Canadian Inflation (March 2023)

Canadian Inflation (March 2023)  Great News On The Inflation Front

Great News On The Inflation Front

The Bank of Canada Holds Rates Steady Again But Maintains Its Commitment To 2% Inflation

The Bank of Canada Holds Rates Steady Again But Maintains Its Commitment To 2% Inflation Bank of Canada Interest Rate Announcement

Bank of Canada Interest Rate Announcement