Our proven online marketing get properties sold at a premium and in a shorter amount of time. Our intimate knowledge of the Vancouver market, and extensive experience, ensures your purchase or sale goes without a hitch.

Let’s get coffee.

Posted on Mar 21, 2023 in Economics

Further Decline in Inflation in February Will Keep the Bank of Canada On Hold in April

Further Decline in Inflation in February Will Keep the Bank of Canada On Hold in AprilPosted on Mar 21, 2023 in Community

How to Stage Your Home for a Quick Sale in Vancouver

How to Stage Your Home for a Quick Sale in VancouverPosted on Mar 21, 2023 in Community

Canadian Inflation (February 2023)

Canadian Inflation (February 2023) Posted on Mar 16, 2023 in Market Update

The Canadian Real Estate Association says home sales in February bounced 2.3 from the previous month. Homeowners and buyers were comforted by the guidance from the Bank of Canada that it would likely pause rate hikes for the first time in a year.

The Canadian Real Estate Association says home sales in February bounced 2.3 from the previous month. Homeowners and buyers were comforted by the guidance from the Bank of Canada that it would likely pause rate hikes for the first time in a year. Posted on Mar 15, 2023 in Economics

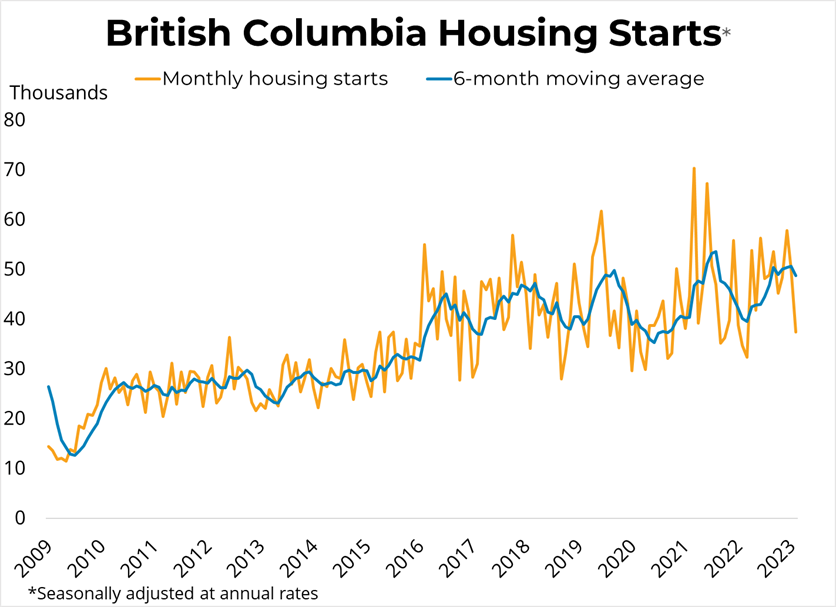

Canadian Housing Starts (February 2023)

Canadian Housing Starts (February 2023)

Posted on Mar 15, 2023 in Economics

US Policymakers Take Emergency Action To Protect Depositors At Failed Banks

US Policymakers Take Emergency Action To Protect Depositors At Failed Banks