Greater Vancouver Retail Sales Announcement - February 2023

Posted on Apr 21, 2023 in Economics

Canadian Retail Sales (February 2023)

Canadian Retail Sales (February 2023)

Canadian seasonally adjusted retail sales fell 0.2 per cent in February to $66.3 billion. Sales fell in 4 of 9 subsectors, but the decrease was led by lower sales at gasoline stations and fuel vendors (-5.0 per cent) and general merchandise retailers (-1.6 per cent). Core retail sales, which strips out gasoline...

Greater Vancouver Housing started to decrease - March 2023

Posted on Apr 19, 2023 in Economics

Canadian Housing Starts (March 2023)

Canadian Housing Starts (March 2023)

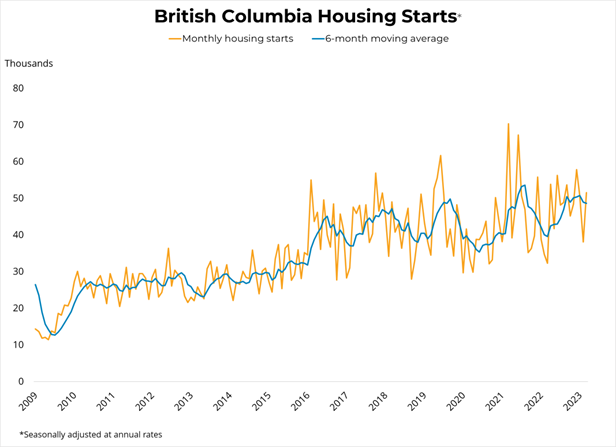

Canadian housing starts fell 11 per cent to 213,865 units in March at a seasonally-adjusted annual rate (SAAR). Starts were down 12 per cent from March of 2022. Single-detached housing starts fell 12 per cent to 56,468 units, while multi-family and others fell 11 per cent to 157,395 (SAAR).

In British Columbia, st...

Canadian Consumer Price Index (CPI) Increases - March 2023

Posted on Apr 18, 2023 in Economics

Canadian Inflation (March 2023)

Canadian Inflation (March 2023)

Canadian prices, as measured by the Consumer Price Index (CPI), rose 4.3 per cent on a year-over-year basis in March, a decrease from the 5.2 per cent rate in February. This large drop was mostly due to base year effects; the CPI was rising quickly this month last year and fuel prices in particular are substantially...

Canadian Inflation Drops to 4.3% in March, Lowest Since 2021

Posted on Apr 18, 2023 in Economics

Great News On The Inflation Front

Great News On The Inflation Front

The Consumer Price Index (CPI) fell sharply in March to 4.3% year-over-year, continuing a pattern of repeated declines. Before we break out the champagne, however, much of the drop in inflation resulted from the steep monthly increase in prices in March one year ago (1.4% m/m), the so-called base-year effects.

Gasol...

Bank of Canada Holds Policy Rate At 4.5%

Posted on Apr 12, 2023 in Economics

The Bank of Canada Holds Rates Steady Again But Maintains Its Commitment To 2% Inflation

The Bank of Canada Holds Rates Steady Again But Maintains Its Commitment To 2% Inflation

The Bank of Canada left the overnight policy rate at 4.5%, as expected, stating their view that inflation will hit 3% by mid-year and reach the 2% target by next year. They admit, however, that demand continues to exceed supply, wage gains are too high, and labo...

Bank of Canada sustained its rate

Posted on Apr 12, 2023 in Economics

Bank of Canada Interest Rate Announcement

Bank of Canada Interest Rate Announcement

The Bank of Canada maintained its overnight rate at 4.5 per cent this morning. In the statement accompanying the decision the Bank noted that demand in Canada still exceeds supply and labour markets remain tight and that first quarter economic growth looks stronger than expected. However, the bank expects c...