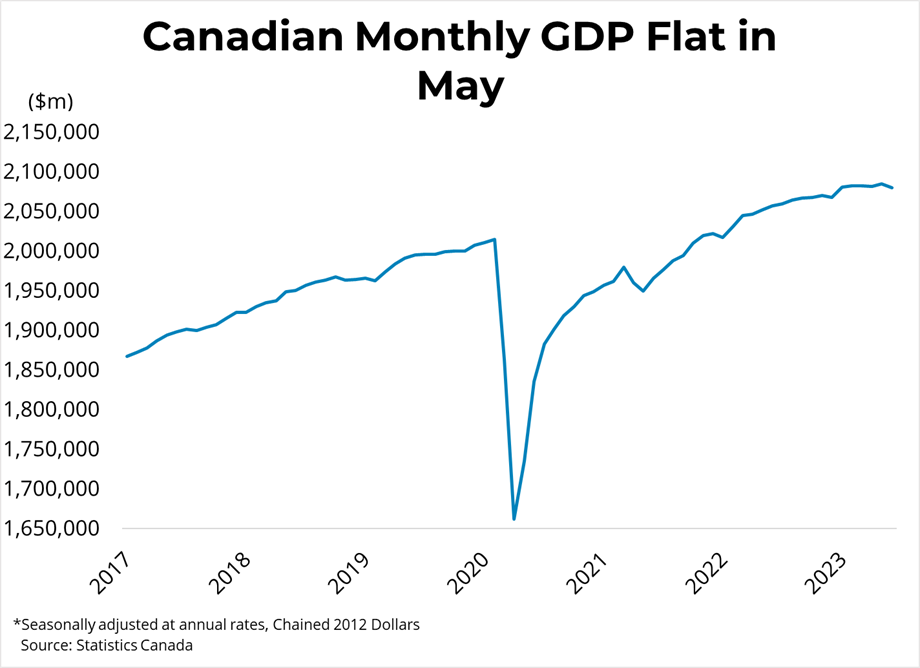

Canadian real GDP fell by 0.2 per cent from the prior month in June, following a 0.2 per cent increase in May. The decline was led by weak wholesale trade, which contracted 3 per cent. Construction activity contracted for the second consecutive month, falling 0.6 per cent primarily due to lower residential building construction (which has been down for 14 of the last 15 months). Offices of real estate agents and brokers, however, rose for the second consecutive month, up 3 per cent, led by higher home reselling activity in BC and Alberta. Canadian real GDP is now roughly 3.5 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy was essentially unchanged in July.

Canadian real GDP fell by 0.2 per cent from the prior month in June, following a 0.2 per cent increase in May. The decline was led by weak wholesale trade, which contracted 3 per cent. Construction activity contracted for the second consecutive month, falling 0.6 per cent primarily due to lower residential building construction (which has been down for 14 of the last 15 months). Offices of real estate agents and brokers, however, rose for the second consecutive month, up 3 per cent, led by higher home reselling activity in BC and Alberta. Canadian real GDP is now roughly 3.5 per cent above its pre-pandemic, February 2020 level. Preliminary estimates suggest that output in the Canadian economy was essentially unchanged in July.GDP was roughly unchanged in the second quarter, after growing 0.6 per cent in the first quarter. The slowdown was driven in large part by weaker housing investment, which fell 2.1 per cent in the second quarter, the fifth consecutive decline. Slower new construction (-8.2 per cent) and renovations (-4.3 per cent) were both driven by higher borrowing costs. Household spending slowed to 0.1 per cent in the second quarter, while slower inventory accumulation and lower net trade also pulled growth downwards. Employee compensation rose 2.2 per cent and household disposable income rose 2.6 per cent, driving the household saving rate to 5.1 per cent in the second quarter.

Higher borrowing costs seemed to finally be widely felt in the second quarter as the Canadian economy posted a softer figure than expected this morning. The economy contracted at an annualized rate of 0.2 per cent, while the preliminary estimate for July was also flat month over month. Following a weak July employment figure, with the Canadian unemployment rate rising to 5.5 per cent, and amid other signs like softer household spending, the slight quarterly contraction in GDP provides support for the Bank of Canada to hold its key interest steady next Wednesday and perhaps conclude this tightening cycle. However, with the inflation figure rising to 3.3 per cent as of the latest data in July, the effects of prior rate hikes still have work to do to bring inflation back down towards the Bank's target of 2 per cent.

Source - BCREA