Summary of Findings

Summary of Findings

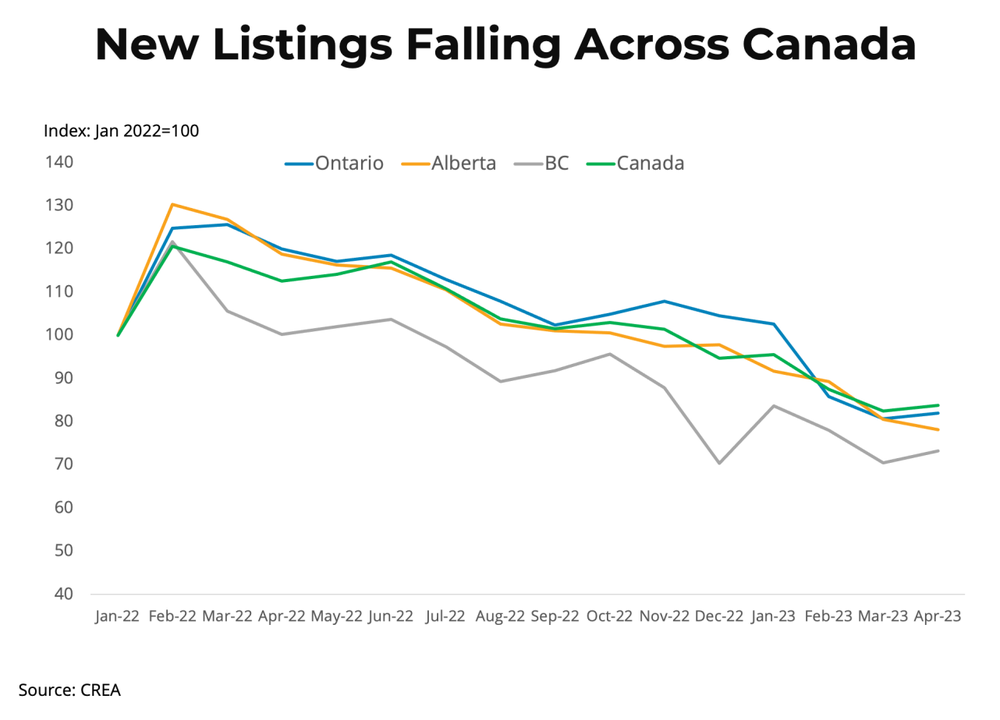

- New listings in BC have fallen to 25 per cent below pre-pandemic norms.

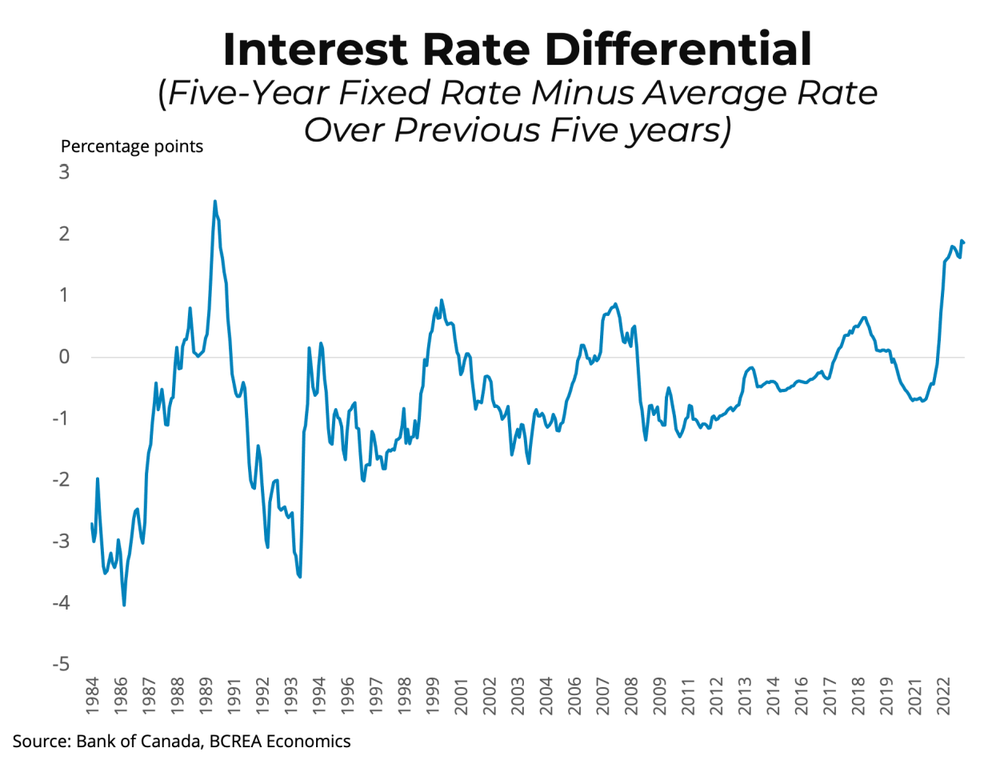

- Most of the explanation for low listings is due to overall slow market activity, but a multidecade high-interest rate differential between old and new mortgages is playing a role.

- The situation should resolve with time, but the current period further highlights the structural problem of chronically undersupplied housing markets, which results in volatility and susceptibility to demand shocks.

Introduction

The post-pandemic housing market has been notable for its stubborn refusal to track expectations. One of the most interesting and unexpected recent housing market trends has been the lack of new listings, which have been trending well below average in all areas of the province since the start of the year. At first blush, the lack of new listings is indeed counterintuitive. With borrowing costs at decade highs and high inflation squeezing household budgets, it seems reasonable to assume that new listings would hold steady, or even rise, as some overburdened households were forced to sell their homes. Instead, new listings have declined substantially in housing markets across Canada.

The post-pandemic housing market has been notable for its stubborn refusal to track expectations. One of the most interesting and unexpected recent housing market trends has been the lack of new listings, which have been trending well below average in all areas of the province since the start of the year. At first blush, the lack of new listings is indeed counterintuitive. With borrowing costs at decade highs and high inflation squeezing household budgets, it seems reasonable to assume that new listings would hold steady, or even rise, as some overburdened households were forced to sell their homes. Instead, new listings have declined substantially in housing markets across Canada. In this Market Intelligence, we show that the pattern of new listings we see is, in fact, a usual outcome of current market dynamics and underlying economic fundamentals. Contrary to expectations, we show that a sharp rise in interest rates has historically been a deterrent to homeowners’ listing their homes. Background New listing activity across Canada has fallen well below normal despite worries of elevated financial vulnerability amongst households due to rising interest rates, high inflation, and fears of a coming recession. As of April, new listings in BC and Canada were both 25 per cent below pre-pandemic norms.

We see four primary factors to explain why listings are so low:

- Low listings can partially be explained by low overall market activity. As high interest rates temper the ability to turn underlying demand for housing into sales, new listings will also tend too lag as buyers are often also sellers. In short, low sales necessarily leads to low new listings. Moreover, current low active listings can reduce future new listing activity, as an overall lack of inventory limits the options of prospective sellers.

- Prices are an essential driver of new listings. If prices are falling, sellers may hesitate to list their home or pull their listing if they perceive that they are not being offered good value from buyers. This is often true as sellers commonly anchor expectations to periods of high prices. Historically, the impulse to hold during periods of declining prices has paid out, as BC housing markets have rarely dropped for long before recovering.

- The resiliency of Canadian labour markets. While fears of a recession have clouded the economy for months, the job market remains robust. The Canadian economy has added nearly 250,000 jobs this year, and the national unemployment rate is hovering near an all-time low. While BC’s economy appears to be slowing, job growth remains positive, and unemployment is low.

- Lastly, the current difference in renewal mortgage rates is the highest since the late 1980s. This means that obtaining a new mortgage is much more expensive for those families who have locked into rates at record-low levels over the past few years.

What is Holding Listings Back in 2023?

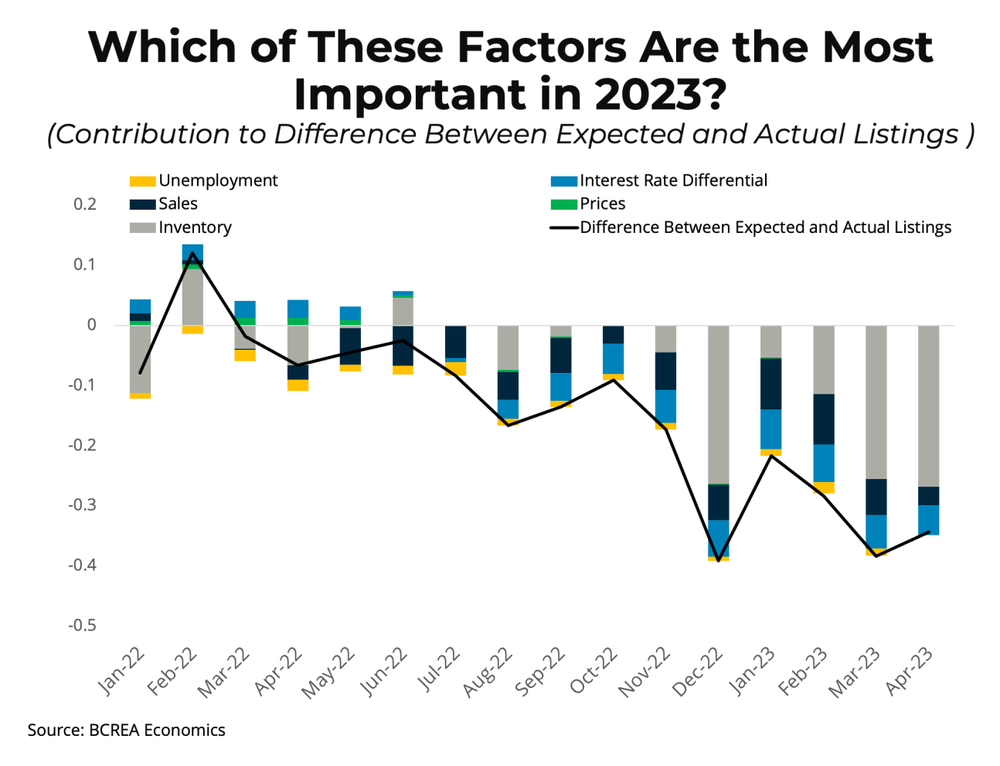

To determine how each factor described above impacts new listings in 2023, we use a neat statistical trick that allows us to estimate and visualize how “shocks” or unexpected changes to each of these factors historically impact the level of new listings1 . Our model's estimated response of new listings to shocks makes intuitive sense. Higher sales lead to higher listings activity, and a rise in the unemployment rate creates financial vulnerability for households, which drives new listings higher. Growing prices tend to push listings modestly higher, while a high differential between current and new mortgage rates keeps potential sellers on the sidelines.

To determine how each factor described above impacts new listings in 2023, we use a neat statistical trick that allows us to estimate and visualize how “shocks” or unexpected changes to each of these factors historically impact the level of new listings1 . Our model's estimated response of new listings to shocks makes intuitive sense. Higher sales lead to higher listings activity, and a rise in the unemployment rate creates financial vulnerability for households, which drives new listings higher. Growing prices tend to push listings modestly higher, while a high differential between current and new mortgage rates keeps potential sellers on the sidelines. On average since the 1980s, shocks to the inventory level are the most important driver of new listings, explaining about half of the total variation. That is, if new listings are low, they will likely stay low as falling inventories limit options for sellers. Conversely, when new listings are high, sellers have many more options, and moving from one house to another is easier. Variation in sales explains 20 per cent, while shocks to the economy explain 14 per cent. This year, it appears that low inventories are limiting the ability of sellers to find suitable options for moving and therefore listing

Lower-than-normal sales activity also keeps new listings low since potential buyers are not looking to list their current homes. A stronger-than-expected labour market is having a modest impact on listings as households are not motivated to sell for financial reasons. Historically, the interest rate differential on new mortgages has not been a consistently significant factor in explaining movement in new listings, explaining less than 10 per cent of variation. However, with that differential being at its highest level in over 30 years, we estimate that the widening cost differential for new mortgages explains about 20 per cent of low listings activity in 2023, lowering the overall pace of new listings this year by an estimated 800 listings per month in BC.

Conclusion

In this Market Intelligence, we showed that low new listing activity in BC is predictable given the macroeconomic and housing context. Low unemployment rates, low sales, off-peak prices, and a high-interest rate differential have collaborated in keeping new listings low since the start of the year. This research also suggests that the below-normal listing activity will likely resolve as interest rate differentials ease and home sales continue to recover, spurring overall market activity. The current period further highlights the structural problem of chronically undersupplied housing markets, which results in volatility and susceptibility to demand shocks. Indeed, prices are already rising even though sales are still below historical norms.Beyond the factors discussed in this Market Intelligence, there may also be long-term demographic factors at play in explaining low listings, particularly in parts of BC where populations skew toward retirees. BC’s demographics are pretty favourable for housing demand, given the considerable size of the population cohort aged 25 to 40, who tend to be seeking more housing to start families. At the same time, the large cohort of people over 60 prevents supply from being unlocked as these seniors age in place. Those in the younger cohort are less likely to have a home to sell, while the latter cohort is often comfortably housed, without a mortgage, and settled in their home without the intention of moving.

Source - BCREA