Further Decline in Inflation in January Affirms Bank of Canada Pause in March

Canadian inflation decelerated meaningfully in January despite the continued strength in the economy. Labor markets remain very tight, and retail sales continue to be strong. Nevertheless, the Bank of Canada's jumbo rate hikes over the past eleven months have tempered inflation from a June '22 peak of 8.1% y/y to 5.9% in January.

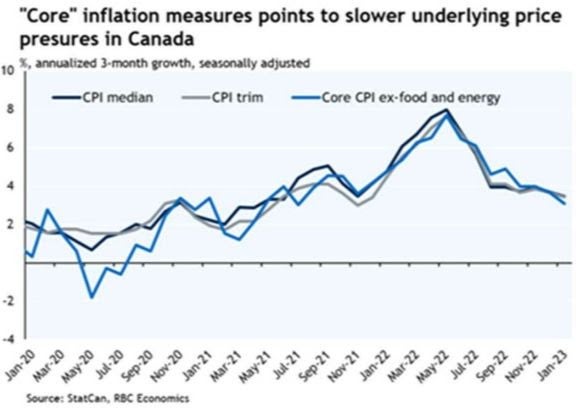

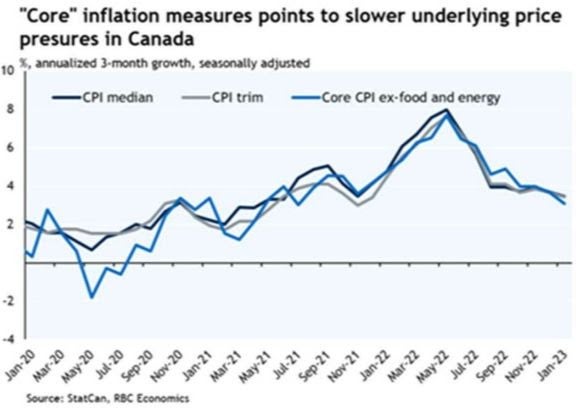

The 3-month average growth in the Bank of Canada's preferred median and trim inflation measures – designed to look through volatility in individual product prices to better gauge underlying price pressures – are running at around 3.5% on a three-month annualized basis. That's still above the BoC's 2% inflation target but is well below peak levels last year.

Prices for cellular services and passenger vehicles contributed to the deceleration in the all-items CPI. However, mortgage interest costs and food prices continue to rise.

Last month, inflation excluding food and energy, rose 4.9% y/y. Prices excluding mortgage interest costs rose 5.4%. In both cases, year-over-year price growth was slower than in December. Some of the declines in inflation were due to base-year effects. In January 2022, mounting tensions amid the threat of a Russian invasion of Ukraine, coupled with supply chain disruptions and higher housing prices, put upward pressure on prices.

Monthly, the CPI rose 0.5% in January 2023, following a 0.6% decline in December. Higher gasoline prices contributed the most to the month-over-month increase, followed by a rise in mortgage interest costs and meat prices.

Another critical factor in today's data is that inflation in services eased to 5.3% from 5.6%.

Food prices, however, remain elevated in January (+10.4%) compared to 10.1% in December. Grocery price acceleration in January was partly driven by year-over-year growth in meat prices (+7.3%), resulting from the most significant month-over-month increase since June 2004. Food purchased from restaurants also rose faster, rising 8.2% in January following a 7.7% increase in December.

The Bank of Canada must feel pretty good about today's inflation numbers. They confirm the wisdom of their announced pause in rate hikes at the January meeting. Despite continued strength in the labor market and January retail sales, headline and core inflation measures have declined again, with a five handle now on the headline rate. That is still a long way to the 3.0% inflation forecast by the end of this year, but it is moving in the right direction.

There will be no BoC action when they meet again on March 8. Their press release will be scrutinized for a hawkish versus dovish tone. Regardless of upcoming data, there is virtually no chance of any rate cuts this year.

Food prices, however, remain elevated in January (+10.4%) compared to 10.1% in December. Grocery price acceleration in January was partly driven by year-over-year growth in meat prices (+7.3%), resulting from the most significant month-over-month increase since June 2004. Food purchased from restaurants also rose faster, rising 8.2% in January following a 7.7% increase in December.

Bottom Line

The Bank of Canada must feel pretty good about today's inflation numbers. They confirm the wisdom of their announced pause in rate hikes at the January meeting. Despite continued strength in the labor market and January retail sales, headline and core inflation measures have declined again, with a five handle now on the headline rate. That is still a long way to the 3.0% inflation forecast by the end of this year, but it is moving in the right direction.

There will be no BoC action when they meet again on March 8. Their press release will be scrutinized for a hawkish versus dovish tone. Regardless of upcoming data, there is virtually no chance of any rate cuts this year.

Source – Dr. Sherry Cooper – Dominion Lending