Rising mortgage rates brought uncertainty and caution to Metro Vancouver’s housing market in 2022

Rising mortgage rates brought uncertainty and caution to Metro Vancouver’s housing market in 2022

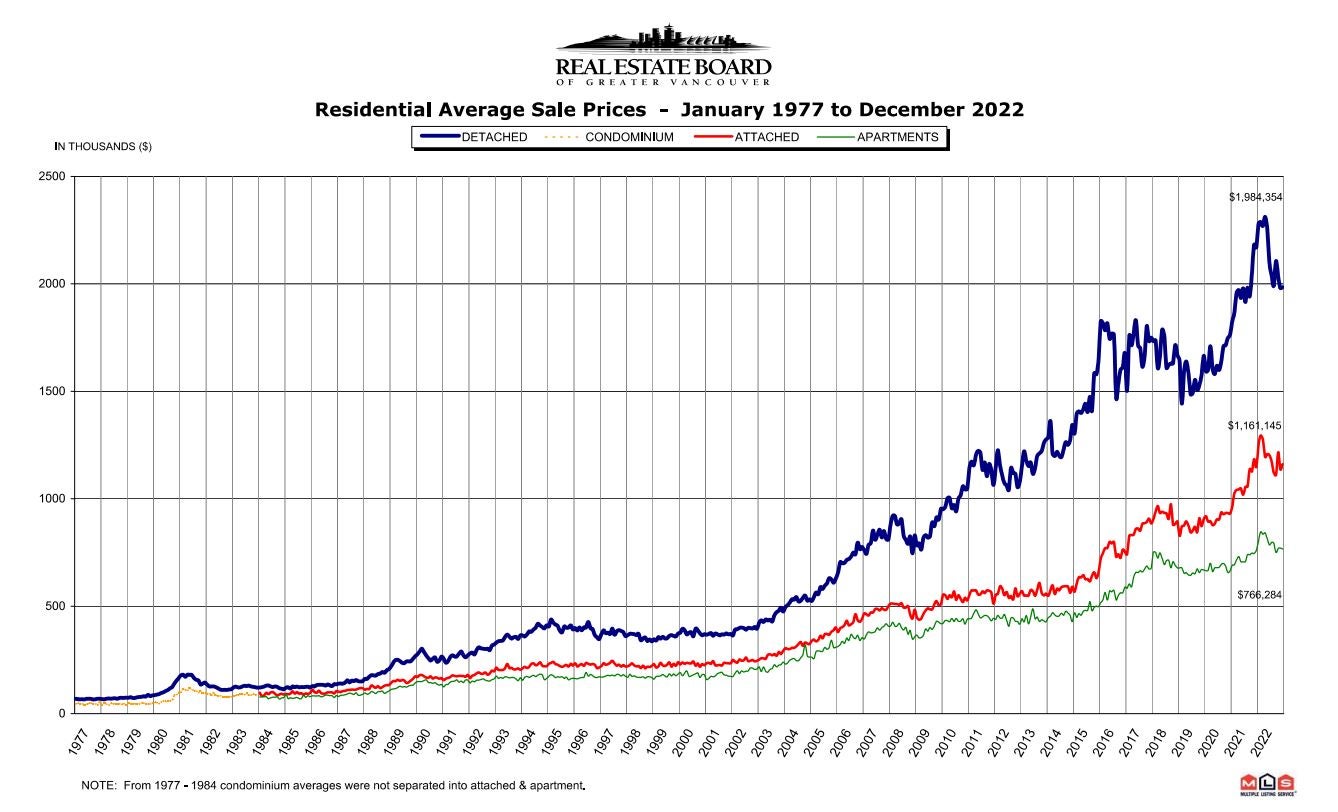

After seeing record sales and prices during the pandemic, Metro Vancouver’s housing market experienced a year of caution in 2022 due to rising borrowing costs fueled by the Bank of Canada’s ongoing battle with inflation.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totaled 28,903 in 2022, a 34.3 percent decrease from the 43,999 sales recorded in 2021, and a 6.6 percent decrease from the 30,944 homes sold in 2020.

Last year’s sales total was 13.4 percent below the 10-year sales average.

“The headline story in our market in 2022 was all about inflation and the Bank of Canada’s efforts to bring inflation back to target by rapidly raising the policy rate. This is a story we expect to continue to make headlines into 2023, as inflationary pressures remain persistent across Canada, "Andrew Lis, REBGV’s director, of economics and data analytics said.

Home listings on the Multiple Listing Service® (MLS®) in Metro Vancouver reached 53,865 in 2022. This is a 13.5 percent decrease compared to the 62,265 homes listed in 2021 and a 0.8 percent decrease compared to the 54,305 homes listed in 2020.

Last year’s listings total was 3.2 percent below the region’s 10-year average.

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 7,384, a 41 percent increase compared to December 2021 (5,236) and a 19.6 percent decrease compared to November 2022 (9,179).

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,114,300. This represents a 3.3 percent decrease over December 2021, a 1.5 percent decrease compared to November 2022, and a 9.8 percent decrease over the past six months.

“Closing out 2022, the data show that the Bank of Canada’s decisions to increase the policy rate at seven of the eight interest rate announcement dates in 2022 has translated into downward pressure on home sale activity and, to a lesser extent, home prices in Metro Vancouver,” Lis said. “While the consensus among many economists and forecasters suggests the Bank of Canada may be near the end of this tightening cycle, rates may remain elevated for longer than previously expected since the latest inflation figures aren’t showing signs of abating quickly. We’ll watch the 2023 spring market closely to see if buyers and sellers have adjusted to the higher borrowing costs and are participating more actively in the market than we have seen over the last 12 months.”

December 2022 summary

Residential home sales in the region totaled 1,295 in December 2022, a 51.8 percent decrease from the 2,688 sales recorded in December 2021, and a 19.8 percent decrease from the 1,614 homes sold in November 2022.Last month’s sales were 37.7 percent below the 10-year December sales average.

There were 1,206 detached, attached, and apartment properties newly listed for sale on the MLS® in Metro Vancouver in December 2022. This represents a 38 percent decrease compared to the 1,945 homes listed in December 2021 and a 60.5 percent decrease compared to November 2022 when 3,055 homes were listed.

For all property types, the sales-to-active listings ratio for December 2022 is 17.5 percent. By property type, the ratio is 12.3 percent for detached homes, 19.5 percent for townhomes, and 21.7 percent for apartments.

Generally, analysts say downward pressure on home prices occurs when the ratio dips below 12 percent for a sustained period, while home prices often experience upward pressure when it surpasses 20 percent over several months.

Sales of detached homes in December 2022 reached 371, a 53.3 percent decrease from the 794 detached sales recorded in December 2021. The benchmark price for a detached home is $1,823,300. This represents a 5.1 percent decrease from December 2021, a 1.8 percent decrease compared to November 2022, and an 11.4 percent decrease over the past six months.

Sales of apartment homes reached 702 in December 2022, a 52 percent decrease compared to the 1,464 sales in December 2021. The benchmark price of an apartment home is $713,700. This represents a 1.7 percent increase from December 2021, a 0.9 percent decrease compared to November 2022, and a 6.9 percent decrease over the past six months.

Attached home sales in December 2022 totaled 222, a 48.4 percent decrease compared to the 430 sales in December 2021. The benchmark price of an attached home is $1,012,700. This represents a 0.2 percent decrease from December 2021, a 1.5 percent decrease compared to November 2022, and a 9.2 percent decrease over the past six months.

Source - REBGV