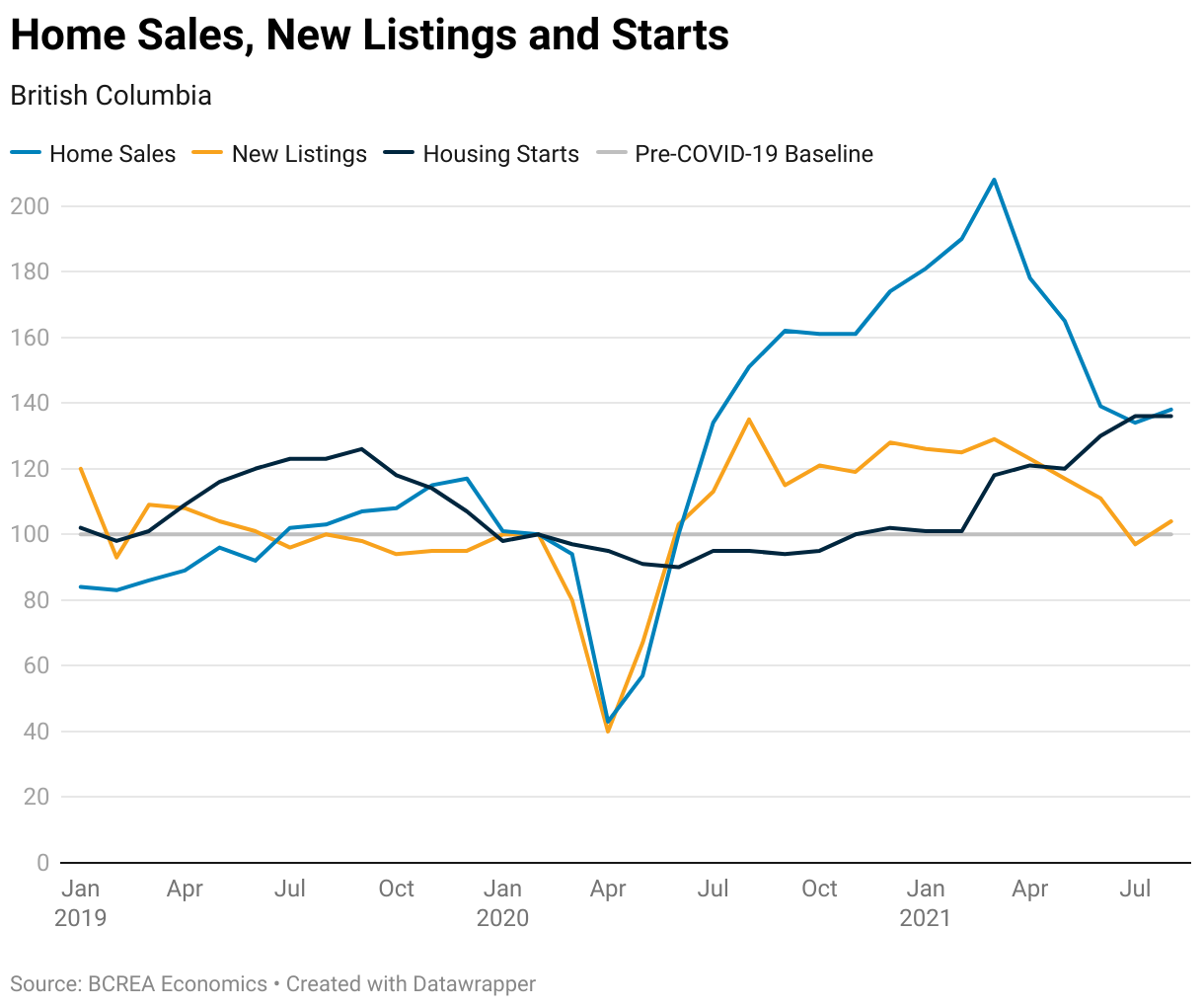

In September, sales, new listings and housing starts in BC all declined somewhat from August, extending the calming trend relative to peaks in March. While MLS® sales rose slightly in most regions of the province, a decline in the large market of the lower mainland caused a decline overall. Rental rates remain elevated in Victoria and Vancouver relative to pre-pandemic levels amid generally high consumer price appreciation.

In September, sales, new listings and housing starts in BC all declined somewhat from August, extending the calming trend relative to peaks in March. While MLS® sales rose slightly in most regions of the province, a decline in the large market of the lower mainland caused a decline overall. Rental rates remain elevated in Victoria and Vancouver relative to pre-pandemic levels amid generally high consumer price appreciation.Retail sales in BC rose in August to a fresh record, with sales 8.6 per cent above the same month last year. As of October, restaurant reservations in Vancouver are near the highest level since the onset of the pandemic, at roughly 80 per cent of the pre-pandemic level. This contrasts with a drop in reservations in Montreal and Toronto relative to post-pandemic peaks in late August. In BC, Google’s measure of movement trends remains high, although below the peak in late summer, currently about 14 per cent below pre-pandemic levels.

Although aggregate employment has recovered in BC to pre-pandemic levels, the accommodation and food service sector is about 9 per cent below the pre-pandemic level. The labour market has served high-income workers much better than low-income workers. Employment in high-income industries is about 10 per cent above pre-pandemic employment levels, while employment in low-income industries is about 6 per cent below pre-pandemic employment levels. Manufacturing in BC dropped for a second month in August mostly due to a 18 per cent drop in sales of wood products. Exports in the province edged up in August, while imports surged 21 percent to a fresh record. Consumer and business confidence in BC contracted slightly in September amid new COVID-19 restrictions. In August, US tourists finally began reentering the province, hitting roughly 20 per cent of the February 2020 level.

Source - BCREA