• The unusual circumstances of the COVID-19 pandemic produced an unexpected and substantial increase in housing demand while the supply of listings fell.

• The unusual circumstances of the COVID-19 pandemic produced an unexpected and substantial increase in housing demand while the supply of listings fell. • As a result, buyers outnumbered sellers by as much as 2.5 to 1 in some months with markets in Victoria and the Fraser Valley seeing more than 7 potential buyers for every seller.

• While demand has normalized somewhat, most provincial markets remain severely under-supplied and therefore far from balanced.

Introduction During the COVID-19 pandemic, the demand for housing surged across BC despite a severe recession and closed borders. As a result of the crisis and lockdowns, homebuyers prioritized square footage over characteristics such as proximity to the urban core.

This preference shift generated considerable relocation demand as square footage could be more easily purchased in smaller, less densely populated regions. Home prices rose in smaller markets which did not have adequate housing supply to absorb the large and sudden increase in demand. In this Market Intelligence, we use a novel modelling approach to estimate the total number of interested buyers over the course of the pandemic and highlight which regions suffered the most severe imbalances of supply and demand.

Methodology A common theme across all markets during the past year, especially at the height of market activity in the spring of 2021, was the presence of multiple offers on listings. However, it is difficult to measure this phenomenon since only successful transactions are observable in the statistics and there are always buyers in the market that are unable to find homes. Therefore, sales statistics are only capturing a share of the potential pool of buyers. The market’s ability to satisfy total buyer demand depends on the availability of houses to purchase, measured by total listings, and the market’s efficiency at matching buyers with sellers.

There are some markets where the ability to match buyers and sellers is very difficult due to factors such as demographics, affordability, and the characteristics of the housing stock. In these markets, we are more likely to observe more buyers than sellers, multiple offers, and accelerating prices. Using a model framework recently developed by researchers at the US Federal Reserve, we can gain insight into how total demand evolved over the pandemic in different regions of the province and how much supply may be needed to bring

While the estimates of total demand produced by the model are ultimately just estimates of an unobservable variable, the results of this modelling exercise certainly match what we have observed in markets across the province, with estimated total demand overwhelming the supply of listings.

Supply-Demand Analysis

From our analysis, we estimate that total demand for housing in the province surged during the pandemic to its highest level on record. At the peak of market activity in March 2021, an estimated 67,000 buyers were searching for homes across BC while only 24,000 listings were available that month. The result was significant upward pressure on prices and transactions often occurring after multiple offers.Ultimately, some portion of this demand was satisfied through sales while other potential buyers exited the market due to affordability constraints or were otherwise discouraged due to dwindling supply. As the number of buyers has declined since March, the MLS® average sale price has been essentially flat on a monthly basis. On the supply side, the total inventory of homes for sale has been sliding downwards since before the pandemic. Once the pandemic struck in early 2020, the decline in listings activity continued as potential sellers withdrew from the market.

New listings did recover after pausing during the initial months of the pandemic but have since declined to pre-pandemic levels. Net new listings (new listings minus withdrawals) are tightly correlated with net new buyers since most buyers are also sellers. At the onset of the pandemic, new buyers and new listings both sharply declined as the pandemic halted market activity. However, potential buyers swiftly returned to the market in early summer, outpacing new listings activity for several months.

Additional Supply Needed to Restrain Prices

The average home price in BC has increased by close to 25 per cent since the start of the pandemic. Even with total demand now currently trending toward historically average levels, we estimate that the provincial market would have needed to roughly double the number of active listings available over the course of the pandemic to meet the surge in demand and keep prices flat over the period.

Historically, the gap between the number of buyers and sellers has been predictive of growth in home prices. As expected, there is a strong positive correlation between our estimate of the ratio of total demand to active listings and growth in home prices, with prices rising much faster as the ratio of buyers to sellers rises. Our estimates show this ratio was particularly elevated during the spring of 2021, with buyers outnumbering sellers by a ratio of almost 3 to 1.

The imbalance between supply and demand was even more pronounced in regions of the province experiencing significant relocation demand. Whether due to remote work opportunities, a pandemic-induced desire for space, or accelerated retirement plans, buyers flooded into markets on Vancouver Island, the Fraser Valley and the Okanagan, overwhelming limited supply and causing significant price increases. We examine these regional trends in the following sections.

Regional Markets

Since 2019, the number of active listings has declined in all four major regions of BC. As of August, the number of active listings ranged between 50 per cent and 80 per cent of the corresponding value in January 2019 in the same region.While the number of available properties declined, the number of buyers searching for properties surged shortly after the start of the pandemic. Naturally, this resulted in a rapidly rising buyer-to seller ratio. In most regions of BC, the buyer-to-seller ratio briefly dropped at the start of the pandemic, reaching the nadir in April 2020, but in the following months it quickly rose, dragging prices upwards.

In most markets, the ratio hit its peak in March 2021, which was also the peak of prices and sales. It has since declined but remains elevated by historical standards. The following sections examine each region individually.

Lower Mainland

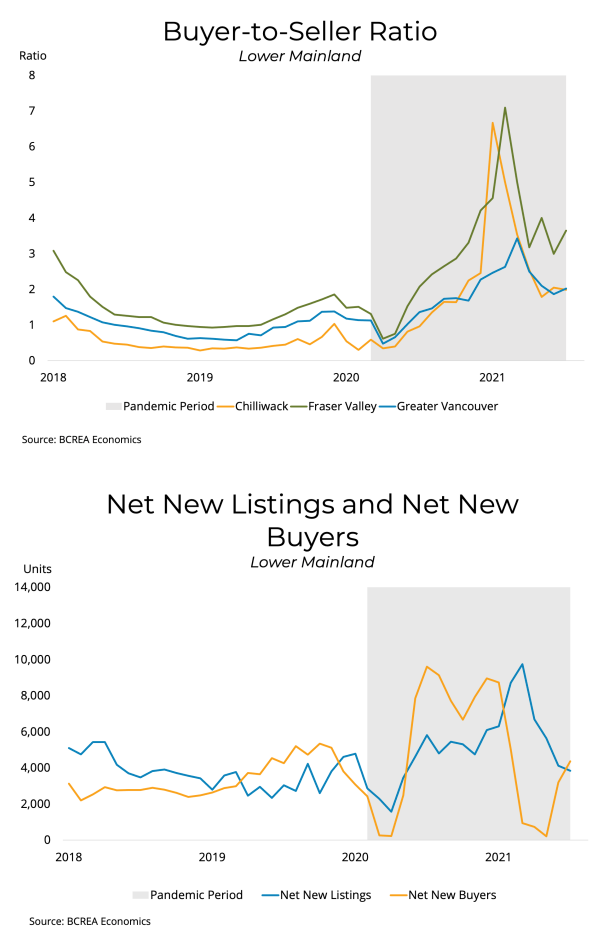

The buyer-to-seller ratio in the Lower Mainland tracks the overall value for BC very closely. During the slowdown of 2018 and 2019, buyers and sellers were closely matched, with demand picking up right before the pandemic prompting a drop in market activity. The ratio then rose rapidly until March 2021, surpassing a value of three, before declining to a value that remains elevated by historical standards. The ratio for the individual real estate board areas located in the Lower Mainland reveals some very interesting trends.

The buyer-to-seller ratio in the Lower Mainland tracks the overall value for BC very closely. During the slowdown of 2018 and 2019, buyers and sellers were closely matched, with demand picking up right before the pandemic prompting a drop in market activity. The ratio then rose rapidly until March 2021, surpassing a value of three, before declining to a value that remains elevated by historical standards. The ratio for the individual real estate board areas located in the Lower Mainland reveals some very interesting trends. While the regions covered by the Real Estate Board of Greater Vancouver saw a sharp increase in the ratio of buyers to sellers, that increase paled in comparison to Chilliwack and markets within the Fraser Valley Real Estate Board such as Surrey, Langley, and Abbotsford. Those markets saw an enormous rise in total demand during the pandemic as potential buyers looked outside of the Vancouver area for more affordable space.

We estimate that at the height of the market during the spring, buyers outnumbered sellers by as much as 7 to 1 in the Fraser Valley and Chilliwack, resulting in many transactions involving multiple offers and rapidly escalating home prices. Indeed, while home prices rose about 14 per cent in the Greater Vancouver Area, prices in the Fraser Valley and Chilliwack were up close to 30 per cent.

Conclusions

The model-based estimates of the imbalance between supply and demand in this report confirm the trends observed throughout the pandemic as well as the broader long-run issues contributing to challenging affordability in BC. The surge in demand during the pandemic, prompted by shifting buyer preferences and record low borrowing costs, caused a substantial increase in home prices, especially in smaller markets that did not have adequate supply to absorb a sudden increase in demand.

While the pandemic is a rare event, the experience of the housing market during this unusual time further highlights how challenging it is for supply in the housing market to keep up with rapidly changing demand. This is particularly true in markets where the supply of new housing has been hampered by delays caused by municipal processes and approvals. Without a coordinated strategy among all levels of government that incentivizes municipal governments to meet housing targets, we will continue to have markets that are vulnerable to rapid price increases at times when we see large shifts in demand.

Source - BCREA