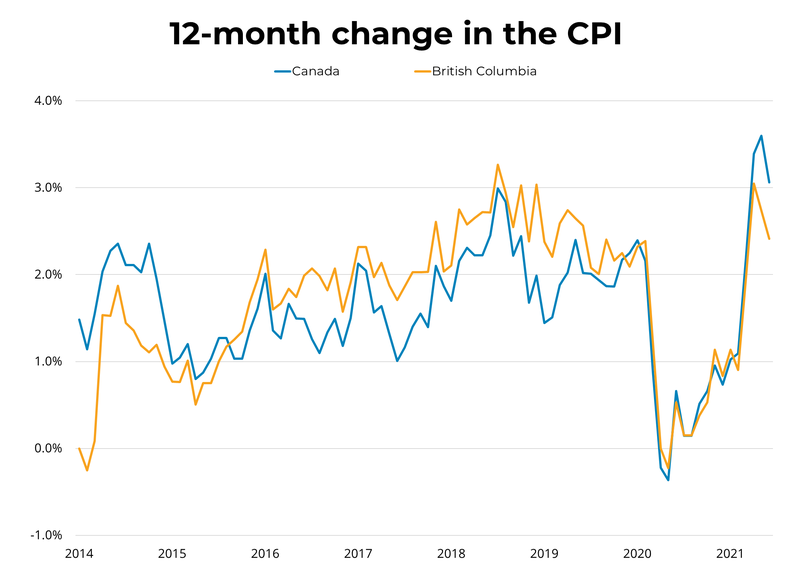

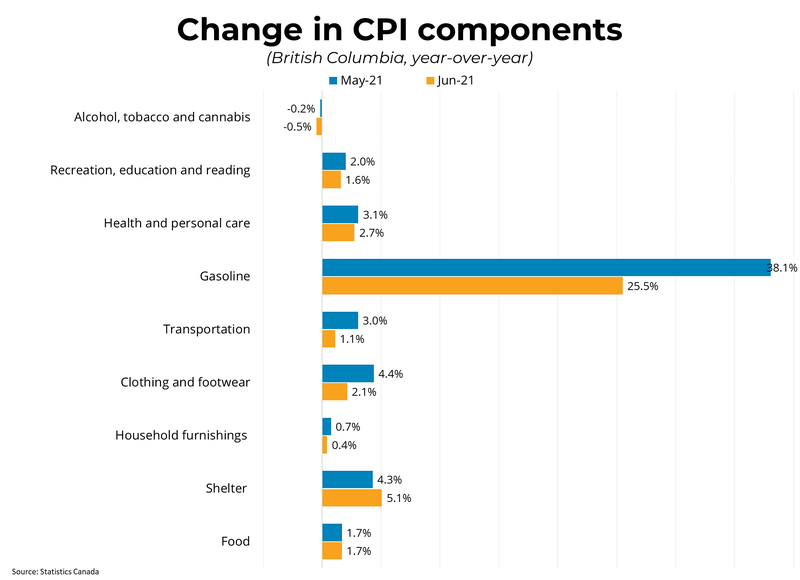

Canadian prices, as measured by the Consumer Price Index (CPI), rose 3.1% on a year-over-year basis in June, down from the prior two months. The downward pull of "base-year effects" are no longer influencing the year-over-year CPI values, as June 2020 prices had recovered from dips in the early months of the pandemic. On a seasonally adjusted month-over-month basis, the CPI was up just 0.1% in June. The Bank of Canada's preferred measures of core inflation (which use techniques to strip out volatile elements) rose an average of 2.3% year-over-year in June. In BC, consumer prices were up 0.5% month-over-month, and up 2.4% on a year-over-year basis in June.

Canadian prices, as measured by the Consumer Price Index (CPI), rose 3.1% on a year-over-year basis in June, down from the prior two months. The downward pull of "base-year effects" are no longer influencing the year-over-year CPI values, as June 2020 prices had recovered from dips in the early months of the pandemic. On a seasonally adjusted month-over-month basis, the CPI was up just 0.1% in June. The Bank of Canada's preferred measures of core inflation (which use techniques to strip out volatile elements) rose an average of 2.3% year-over-year in June. In BC, consumer prices were up 0.5% month-over-month, and up 2.4% on a year-over-year basis in June.While inflation is currently running higher than the Bank of Canada's 2 per cent target, many economists expect this elevated rate of price increases to be transitory as economies emerge from the pandemic and supply chains normalize. Base-year effects from falling prices during the early months of the pandemic had exaggerated year-over-year changes in CPI, but these effects have now ended, and the rate of increase in CPI is correspondingly lower. The rate of inflation as measured by CPI is very important for the Bank of Canada's monetary policy stance over the next year. If higher inflation is not transitory but instead the result of an over-stimulated economy, the central bank could act to raise interest rates sooner than expected. However, if the uptick in inflation continues to fade in the coming months, we expect the Bank will stay its current course.

Source - BCREA