The Bank of Canada maintained its overnight rate at 0.25 per cent this morning, a level it considers its effective lower bound. The Bank is also continuing its quantitative easing (QE) program, purchasing at least $4 billion of Government of Canada bonds per week and re-affirmed its forward guidance on future interests moves, committing to holding the policy rate at 0.25 per cent until slack in the economy is absorbed and inflation is sustainably trending at 2 per cent. In the statement accompanying the decision, the Bank noted that the recovery underway will be choppy due to rising cases of COVID-19 and will continue to require extraordinary monetary support from the bank.

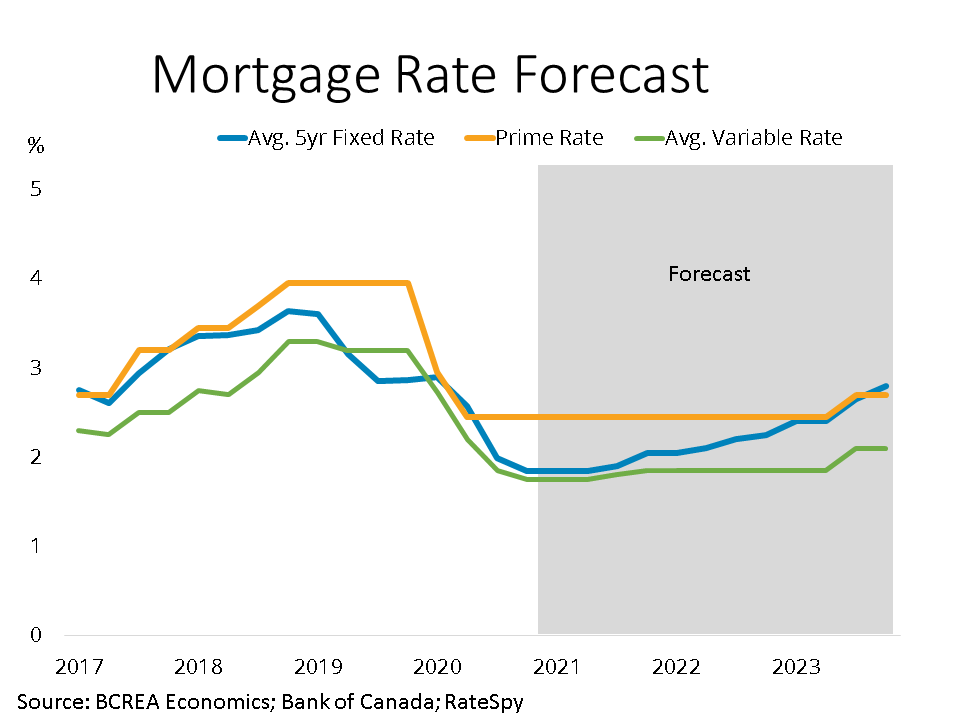

The Bank of Canada maintained its overnight rate at 0.25 per cent this morning, a level it considers its effective lower bound. The Bank is also continuing its quantitative easing (QE) program, purchasing at least $4 billion of Government of Canada bonds per week and re-affirmed its forward guidance on future interests moves, committing to holding the policy rate at 0.25 per cent until slack in the economy is absorbed and inflation is sustainably trending at 2 per cent. In the statement accompanying the decision, the Bank noted that the recovery underway will be choppy due to rising cases of COVID-19 and will continue to require extraordinary monetary support from the bank.Current slack in the economy, along with low energy prices, is holding Canadian inflation well below its target of 2 per cent. Total CPI inflation is trending under 1 per cent while the Bank of Canada’s measures of “core” inflation remain below target despite the massive expansion of the Bank’s balance sheet necessary to facilitate its quantitative easing program. With the arrival of viable vaccines, we may see the Canadian economic recovery materially accelerate in the second half of 2021. If that occurs, the first stage of tighter monetary policy from the Bank will be how and when it decides to taper purchases of government bonds over the next year. As it does, we may start to see a divergence in variable and fixed rates by early summer as bond yields rise and fixed mortgage rates move marginally higher.

Source - BCREA