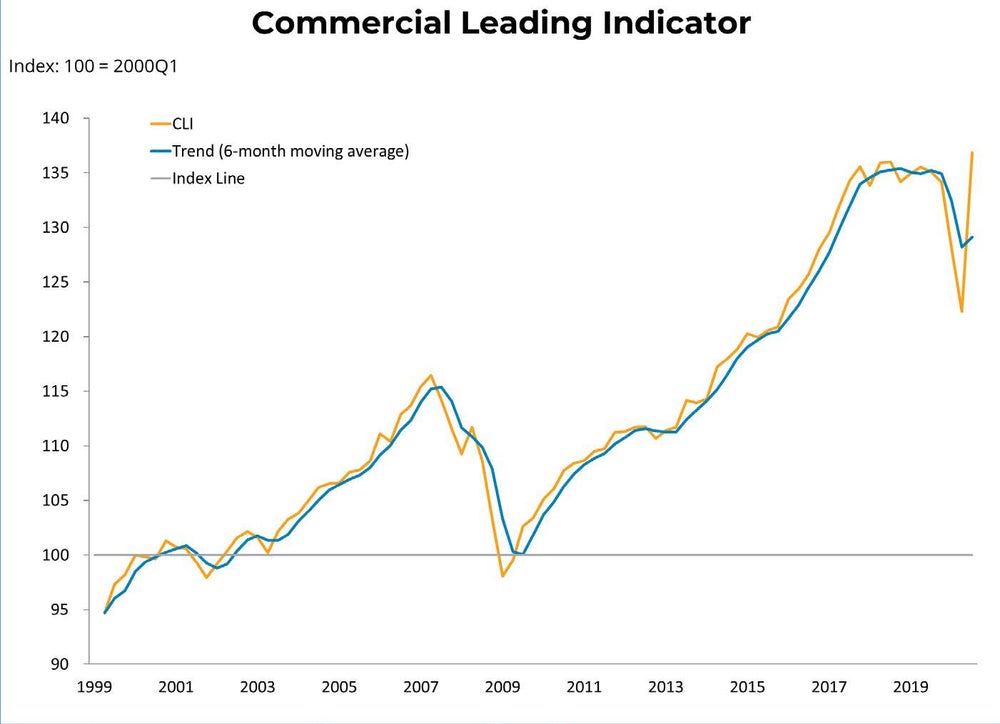

The BCREA Commercial Leading Indicator (CLI) rebounded in the third quarter of 2020 from 122.3 to 136.9, representing the first increase after four consecutive quarterly declines. It was the largest increase in the indicator since the start of the CLI series in 1999, reflecting a recovery from a significant drop in the first half of 2020, due to strict COVID-19 containment measures. Compared to the same time last year, the index was up by 1.3 per cent.

The BCREA Commercial Leading Indicator (CLI) rebounded in the third quarter of 2020 from 122.3 to 136.9, representing the first increase after four consecutive quarterly declines. It was the largest increase in the indicator since the start of the CLI series in 1999, reflecting a recovery from a significant drop in the first half of 2020, due to strict COVID-19 containment measures. Compared to the same time last year, the index was up by 1.3 per cent.The third quarter of 2020 saw the resurgence of key economic industries in BC, particularly the hard-hit retail sector, as brick-and-mortar stores reopened and travel restrictions in the province were eased. Employment in key real estate sectors and manufacturing also rebounded in the third quarter, while the financial component of the CLI declined.

Although the CLI posted a strong recovery in the third quarter of 2020, this is not necessarily reflective of actual commercial real estate conditions, where a rebound in retail sales and employment would normally imply a rebound in retail and office space. The realities of the COVID-19 pandemic are currently driving a wedge between what we see in the data and what is being experienced on the ground.

BC’s economy reopened in the third quarter of 2020 after it was halted in the previous quarter by COVID-19 containment measures. Manufacturing sales were boosted by strong demand for wood products supplying robust activity in new home construction in Canada and the US. The increase in wholesale trade was driven by higher sales in motor vehicles and building materials, as many households undertook home renovations during this period. Retail sales also pulled ahead in the third quarter, increasing by 16.3 per cent, representing the largest quarterly growth since the start of the CLI series in 1999.

BC’s economy reopened in the third quarter of 2020 after it was halted in the previous quarter by COVID-19 containment measures. Manufacturing sales were boosted by strong demand for wood products supplying robust activity in new home construction in Canada and the US. The increase in wholesale trade was driven by higher sales in motor vehicles and building materials, as many households undertook home renovations during this period. Retail sales also pulled ahead in the third quarter, increasing by 16.3 per cent, representing the largest quarterly growth since the start of the CLI series in 1999.Employment growth in key commercial real estate sectors such as finance, insurance, real estate and leasing was up by about 15,000 jobs, recouping all losses reported in the first half of 2020. Manufacturing employment was also up by 12,500, nearly eclipsing job losses that started in the third quarter of 2019.

The CLI’s financial component was negative in the third quarter of 2020, as a fall in REIT prices more than overcame the impact of a reduction in risk spreads due to the Bank of Canada’s actions to provide liquidity in short-term credit markets.