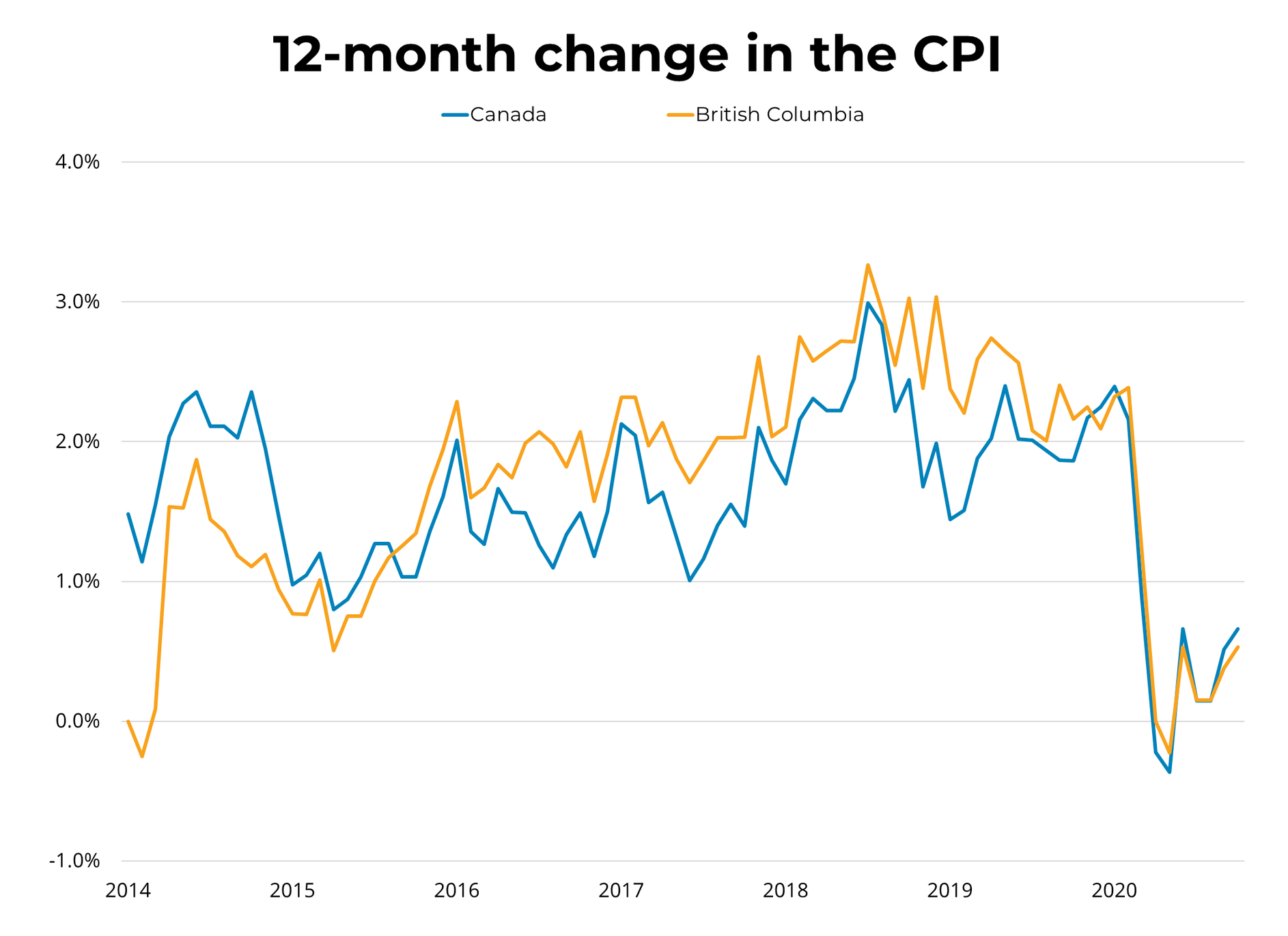

Canadian inflation, as measured by the Consumer Price Index (CPI) rose by 0.7% in October year-over-year, up from the previous month's increase of 0.5%. Excluding gasoline, the CPI rose by 1.1%. Prices rose in five of eight components year-over-year in October, with food contributing the most to the increase due to rising prices for lettuce as a result of disease and inclement weather. Growth in the Bank of Canada's three measures of trend inflation rose by 0.1 percentage points in October, averaging 1.8%.

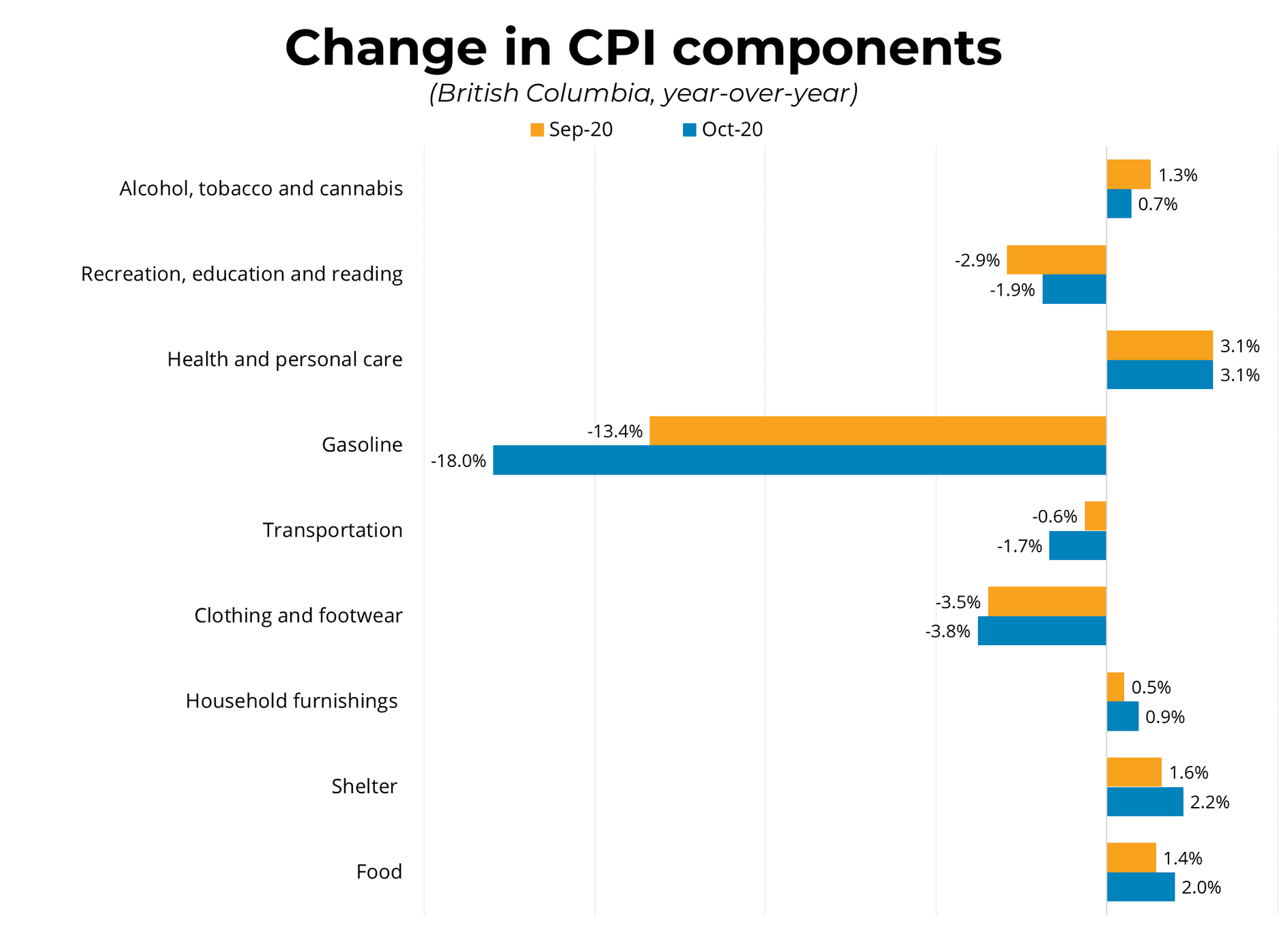

Canadian inflation, as measured by the Consumer Price Index (CPI) rose by 0.7% in October year-over-year, up from the previous month's increase of 0.5%. Excluding gasoline, the CPI rose by 1.1%. Prices rose in five of eight components year-over-year in October, with food contributing the most to the increase due to rising prices for lettuce as a result of disease and inclement weather. Growth in the Bank of Canada's three measures of trend inflation rose by 0.1 percentage points in October, averaging 1.8%. Regionally, the CPI was positive in all provinces. In BC, CPI rose by 0.5% in October year-over-year, up from September's increase of 0.4%. Strong price growth continued for health and personal care (3.1%), shelter (2.2%), and food (2.0%). In contrast, downward price pressures were ongoing in gas (-18.0%), clothing and footwear (-3.8%), and transportation (-1.7%).

Costs for shelter continue to increase, as record-low interest rates put downward pressure on mortgage costs. This has made single-family homes more attractive to households demanding more space. As provinces such as Ontario and Quebec expand their containment measures, and with new restrictions in BC, Canadian inflation is expected to remain subdued. In this environment, the Bank of Canada will continue to keep interest rates low.

Source - BCREA