Summary Findings:

• This is not a typical recession

• This recession has not been felt uniformly across the economy; jobs in high-wage sectors have not been impacted as much as others

• This recession has not been felt uniformly across the economy; jobs in high-wage sectors have not been impacted as much as others

• Swift response from fiscal and monetary policy has helped to boost housing demand and temper financial vulnerability

• Social distancing to stem the spread of COVID-19 prompted a negative supply shock to listings; as demand rebounded, prices felt upward pressure Introduction

• Social distancing to stem the spread of COVID-19 prompted a negative supply shock to listings; as demand rebounded, prices felt upward pressure Introduction

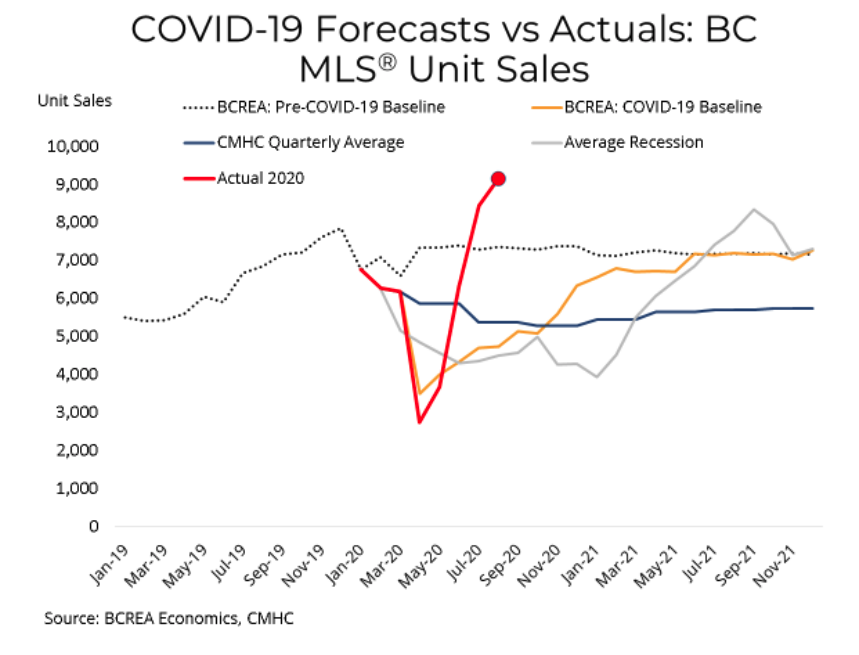

The COVID-19 recession has battered many sectors of the BC economy. However, looking at recent data in the housing market, it would be difficult to tell there was a recession at all. In a typical recession, housing sales decline as job losses and heightened uncertainty prompt potential buyers to pull back from the market. At the same time, the supply of listings accumulates as some households are forced to sell due to rising unemployment and falling incomes.

The COVID-19 recession has battered many sectors of the BC economy. However, looking at recent data in the housing market, it would be difficult to tell there was a recession at all. In a typical recession, housing sales decline as job losses and heightened uncertainty prompt potential buyers to pull back from the market. At the same time, the supply of listings accumulates as some households are forced to sell due to rising unemployment and falling incomes. The COVID-19 recession, however, has been anything but typical. In April, during the early stages of the COVID-19 outbreak, we produced projections of how the pandemic may impact the housing market. Since then, we’ve been able to track the path of the housing market against those original projections, past recessions and other high-profile forecasts.

In this Market Intelligence, we examine how the unusual economics of the pandemic have impacted the housing market, and what that means for the market going forward.

Not a Typical Recession

In past recessions, BC home sales typically posted an initial steep decline before bouncing back along with the wider

In past recessions, BC home sales typically posted an initial steep decline before bouncing back along with the widereconomy. On average, that recovery has taken place over more than a year. In contrast, the COVID-19 recession has

seen a remarkably swift rebound in home sales, not only to pre-COVID-19 levels but to multi-year highs.

seen a remarkably swift rebound in home sales, not only to pre-COVID-19 levels but to multi-year highs.

One of the defining characteristics of the COVID-19 recession is the asymmetric impact on the labour market1. In particular, the heavy burden of job losses has occurred in front-line service sector employment, particularly in the hospitality and restaurant industries. Looking deeper at employment impacts by wage tiers, there is a stark difference in the experience of this recession for high wage sectors versus low-wage sectors.2

These employment impacts are far from the norm. In past recessions, the BC economy has experienced relatively

uniform job losses across all sectors. Indeed, data from past recessions shows the impact on low-wage sectors is often

more muted. However, in the COVID-19 recession, those jobs have been by far hit the hardest, while employment in above-average wage sectors has risen back to pre-COVID-19 levels.

uniform job losses across all sectors. Indeed, data from past recessions shows the impact on low-wage sectors is often

more muted. However, in the COVID-19 recession, those jobs have been by far hit the hardest, while employment in above-average wage sectors has risen back to pre-COVID-19 levels.

The asymmetric impact of the recession helps to explain the strength in home sales, but also has serious implications

for already troubling trends in inequality and housing affordability. This dichotomy may be a lasting legacy of the COVID-19 recession, and an increasing emphasis of government policy.

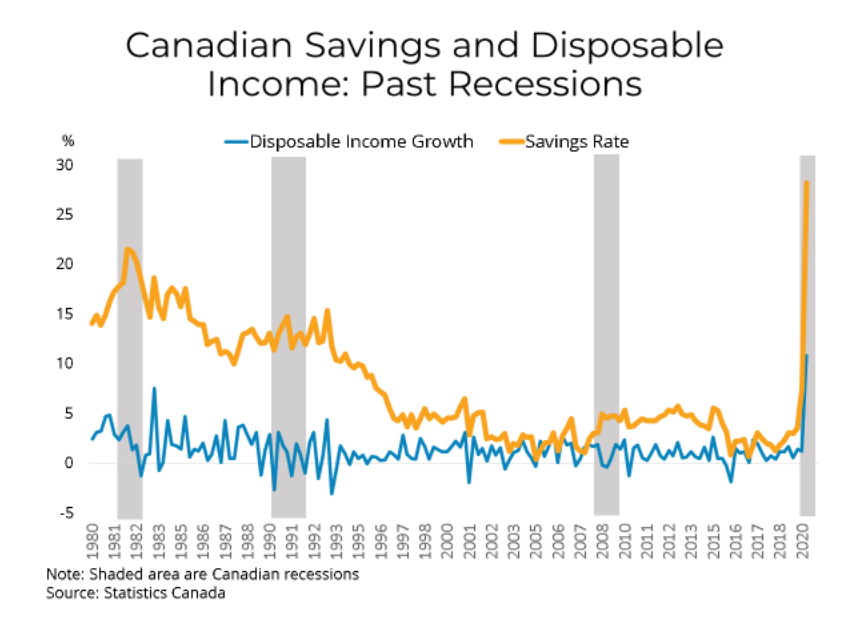

Another unusual hallmark of this recession is the impact on household savings rates and disposable income. Disposable income of Canadian households jumped nearly 11 per cent from the first to the second quarter in 2020, both a record high and a result that is inconsistent with past recessions.

2 These wage tiers are based on wages by sector data from the Canadian Labour Force Survey.

Moreover, without stores open to shop at, without vacations to take, and perhaps with some added precautionary savings, the second quarter of this year saw an extraordinary increase in household savings rates. The Canadian household savings rate climbed to a record high of 28.2 percent in the second quarter of 2020, eclipsing the previous record of 21.2 percent in 1982.

This highly unusual pattern of savings and disposable income growth is at least partially due to the rapid fiscal response from the federal government through the Canadian Emergency Response Benefit (CERB). It would seem that much of the outlay from CERB ended up in the savings accounts of many Canadian households, who may not be in as dire a financial situation as we would typically expect following this type of economic shock, and therefore less likely to be motivated to sell their homes.

Solid high-wage employment, rising disposable incomes, accumulated household savings and historically low

borrowing costs have led to an unusually strong recovery of homes sales following the initial period of the pandemic.

Learning from Past Crises The rapid policy response early in the pandemic shows that policymakers learned important lessons from the 2008-09 financial crisis, particularly embracing the monetary policy axiom of ‘go big and go fast’ when at the effective lower bound for policy rates.

The Bank of Canada not only swiftly brought its overnight rate to its effective lower bound of 25 basis points but also

used the impressive scope of its own balance sheet to counteract a nascent rise in credit spreads. Those measures,

and those of its global counterparts helped to forestall a potential repeat of the credit crisis that shocked the global

economy over a decade ago. The Bank’s foray into quantitative easing, or the purchasing of bonds across the yield curve of short-to-long term maturities, as well as an injection of liquidity into the mortgage market, has resulted in record-low Canadian mortgage rates.

As a result, the pent-up demand from potential buyers sidelined during the initial crisis in April and May was unleashed by the rocket fuel of essentially zero percent 5-year fixed rates, after accounting for 2 percent inflation.

A Negative Supply Shock

While sales activity was unexpectedly strong through the summer, the supply of homes could not keep up. This was not necessarily unexpected. In our last Market Intelligence, we hypothesized a scenario where, due to social distancing

measures, the total supply of active listings may decline during the pandemic.3

As it turns out, this is exactly what happened. While the real estate sector quickly adapted and innovated, using virtual tours and other high-tech and low tech solutions to ensure transactions could safely continue, supply did not accumulate as it has in past recessions, with many potential sellers wary of showing their home or moving during the pandemic.

The impact of social distancing, combined with a remarkably fast and massive rollout of stimulus money directly to households, helped to cushion the sizable blow of historically large job losses, bridging financially vulnerable households through the initial phase of the recession.

3 - “Is it Different This Time?”, BCREA Economics Market Intelligence, April 20, 2020

Potential supply was further dampened by the six-month mortgage deferral program enacted by the Canada Mortgage and Housing Corporation (CMHC). The Bank of Canada estimates that those deferrals have prevented a spike in mortgage delinquencies and therefore a flood of motivated sellers in the market. Consequently, although new listings activity has normalized, the total supply of homes remains both seasonally low and well below past recession peaks.

A Recession with Rising Home Prices?

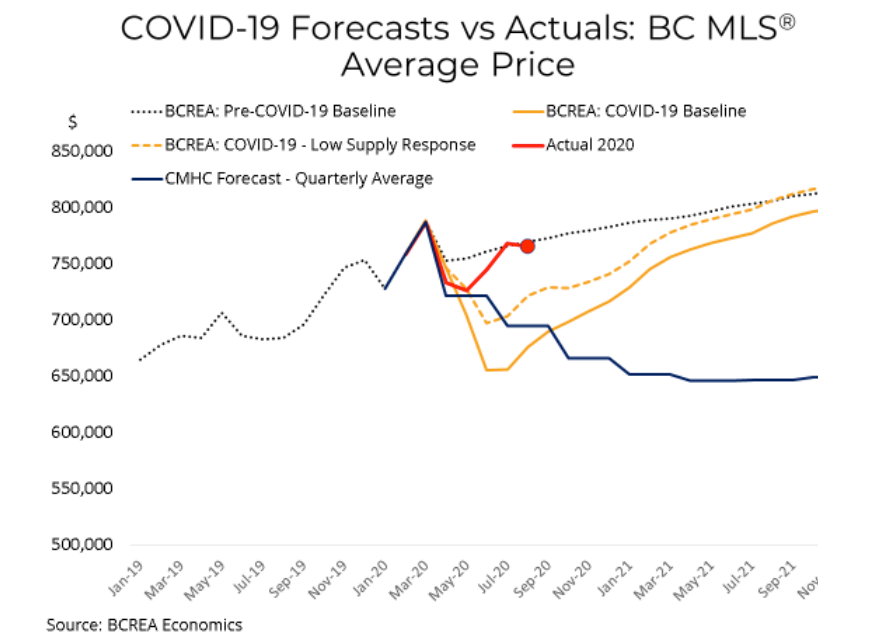

As unusual as it is to see home prices rebound so sharply during a recession, let alone a global pandemic, surprisingly strong home sales, and an undersupplied market has produced strong upward pressure on prices.

The strength of home prices is at odds with typical recession dynamics, and it is therefore not surprising that forecasts based on typical recessions, like the much-discussed spring CMHC outlook, failed to capture the sharp recovery.

Our own original COVID-19 baseline projections, though more accurate than the CMHC, did not anticipate average prices would recover to the pre-COVID-19 baseline until early 2021, even after accounting for the negative shock to active listings.

However, a surge of pent-up demand into an undersupplied market has prices back to pre-COVID-19 levels well ahead of schedule.

Conclusion

This has not been a typical recession and many of the trends we are seeing are without precedent. This means we cannot be certain they will last, and we will continue to approach the performance of the housing market with cautious optimism.

This has not been a typical recession and many of the trends we are seeing are without precedent. This means we cannot be certain they will last, and we will continue to approach the performance of the housing market with cautious optimism.

Indeed, significant uncertainty remains, including the end or transition of key government supports and mortgage deferral programs, and a concerning rise in provincial COVID-19 cases.

However, the unexpectedly swift rebound in the market means that BC home sales will almost certainly finish 2020 higher than 2019. Moreover, the extended low-interest rate environment combined with an expected strong recovery in the BC economy points to a continuation of strong demand in 2021.

One thing we know for sure is that pandemic economics are very unusual and in these unprecedented times, history may not be as strong a guide. As such, the forecasting dictum of “if you have to forecast, forecast often” applies now more than ever.

Source - BCREA