BCREA 2020 Third Quarter Housing Forecast Update

The British Columbia Real Estate Association (BCREA) released its 2020 Third Quarter Housing Forecast Update today.

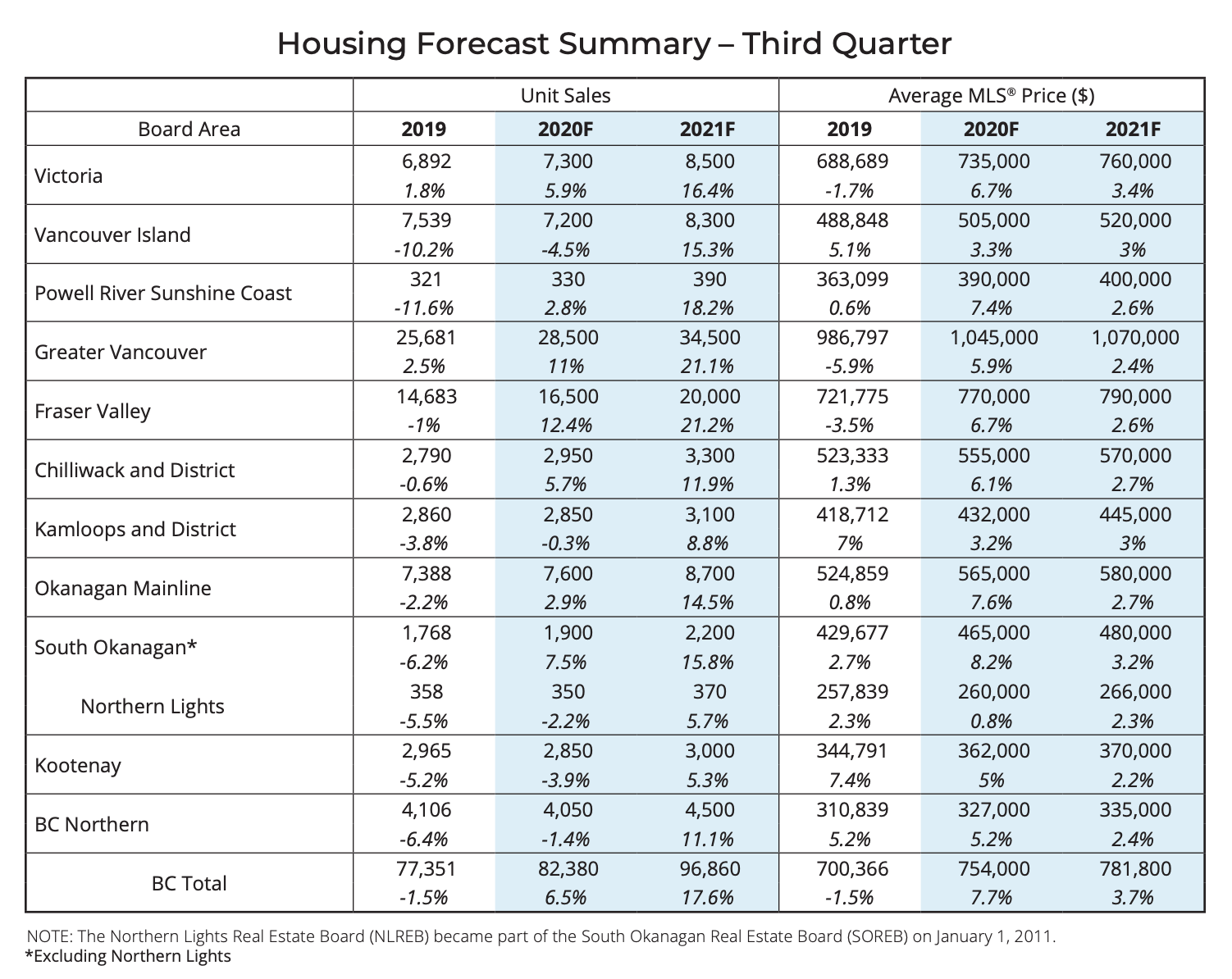

The British Columbia Real Estate Association (BCREA) released its 2020 Third Quarter Housing Forecast Update today.Multiple Listing Service® (MLS®) residential sales in the province are forecast to rise 6.5 per cent to 82,380 units this year, after recording 77,351 residential sales in 2019. MLS® residential sales are forecast to increase 17.6 per cent to 96,860 units in 2021.

“The outlook for the BC housing market is much brighter following a surprisingly strong recovery,” said Brendon Ogmundson, BCREA Chief Economist. “We expect home sales will sustain this momentum into 2021, aided by record-low mortgage rates and a recovering economy.”

With home sales more than fully recovered and now above pre-COVID-19 levels, combined with a decline in the supply of re-sale listings driven by the pandemic, many markets are now seeing sharply rising average prices despite a weak provincial economy. We are forecasting the provincial MLS® average price to finish the year up 7.7 per cent and to increase a further 3.7 per cent in 2021.

Full Extract:

The recession prompted by COVID-19 is on pace to be one of the worst on record for the BC economy. However, looking at recent data in the housing market, it would be difficult to tell there was a recession at all. While home sales

initially fell to historic lows in April, sales have recently soared, more than regaining pre-pandemic levels. Consequently, the outlook for the housing market is much brighter following a stronger than expected summer.

The explanation for the counter-intuitive performance of the housing market lies in the very unusual characteristics of the COVID-19 recession. Unlike in a typical recession, many of the job losses have been felt in lower-wage, frontline service sector jobs, typically held by younger workers. Meanwhile, higher-wage sectors that tend to drive the ownership market have seen employment levels fully recover.

initially fell to historic lows in April, sales have recently soared, more than regaining pre-pandemic levels. Consequently, the outlook for the housing market is much brighter following a stronger than expected summer.

The explanation for the counter-intuitive performance of the housing market lies in the very unusual characteristics of the COVID-19 recession. Unlike in a typical recession, many of the job losses have been felt in lower-wage, frontline service sector jobs, typically held by younger workers. Meanwhile, higher-wage sectors that tend to drive the ownership market have seen employment levels fully recover.

As a result, sales activity has spiked as record-low mortgage rates unleashed a wave of pent-up demand previously sidelined by the pandemic. Moreover, while a recession typically means a buildup of inventory as job losses and falling incomes force households to sell, social distancing measures, mortgage deferrals and sellers’ reluctance to move

during the pandemic caused the supply of re-sale listings to decline through the spring. The combination of strong home sales and an undersupplied market, along with a desire for more space on the part of buyers, has meant that many markets are now seeing sharply rising average prices despite a weak provincial economy.

during the pandemic caused the supply of re-sale listings to decline through the spring. The combination of strong home sales and an undersupplied market, along with a desire for more space on the part of buyers, has meant that many markets are now seeing sharply rising average prices despite a weak provincial economy.

While significant uncertainty remains, including the end or transition of key government supports and a concerning rise in COVID-19 cases, the unexpectedly swift rebound in the market means that BC home sales will almost certainly finish 2020 higher than 2019. We are forecasting total sales of 82,380 this year, before rising to 96,860 in 2021, as a recovering economy and low mortgage rates continue to drive demand. The average home price is forecast to rise

7.7 per cent this year and 3.7 per cent in 2021.

7.7 per cent this year and 3.7 per cent in 2021.

Source - BCREA