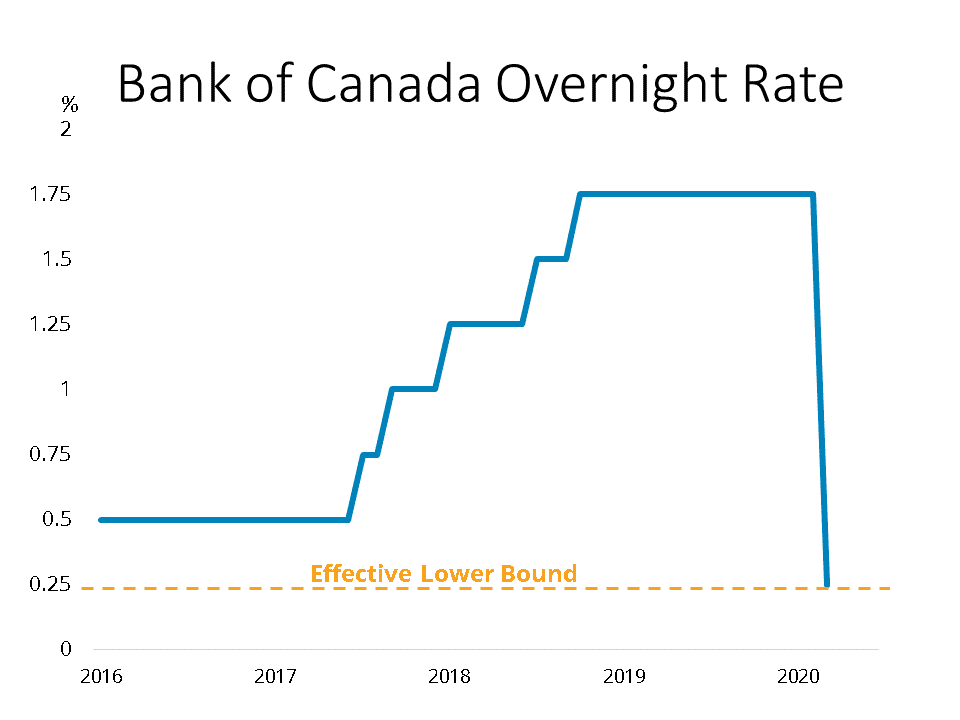

For the second time this month, the Bank of Canada has lowered its overnight policy rate before its regularly scheduled announcement date, taking the overnight rate down a further 50 basis points to 0.25 per cent. That level is what the Bank considers its effective lower bound, meaning it can not reduce rates further without potentially disrupting key short-term funding markets.

For the second time this month, the Bank of Canada has lowered its overnight policy rate before its regularly scheduled announcement date, taking the overnight rate down a further 50 basis points to 0.25 per cent. That level is what the Bank considers its effective lower bound, meaning it can not reduce rates further without potentially disrupting key short-term funding markets.The Bank also announced two new programs to ensure the continued smooth functioning of credit markets and to promote credit availability. The first, the Commercial Paper Purchase Program, is targeted at alleviating strains in the short-term funding market and the second entails the Bank purchasing Government of Canada bonds in the secondary market. The latter program is a type of what is generally called "quantitative easing" though the Bank's program is targeted at all maturities, rather than longer term yields as in traditional quantitative easing.

All of these actions represent a serious and significant amount of firepower aimed at keeping the Canadian financial system and credit markets functioning during this extraordinary time. If successful, we should see currently elevated risk spreads on mortgage products start to decline, reversing recent increases in Canadian mortgage rates.